USD/CAD turns sideways after rallying around 1.3250

The USD/CAD pair oscillates in a narrow range after a rally around 1.3250 in the European session. Strength in the US Dollar is backed by Greenback’s fresh three-week high formed around 102.14. The Loonie asset is expected to deliver further action after guidance from United States Manufacturing PMI data. S&P500 futures extend losses in London, portraying caution among market participants ahead of key economic data. The US Dollar Index continues its three-day winning spree on Tuesday as investors expect that the Federal Reserve (Fed) could continue hiking interest rates so that price stability could be achieved quickly.

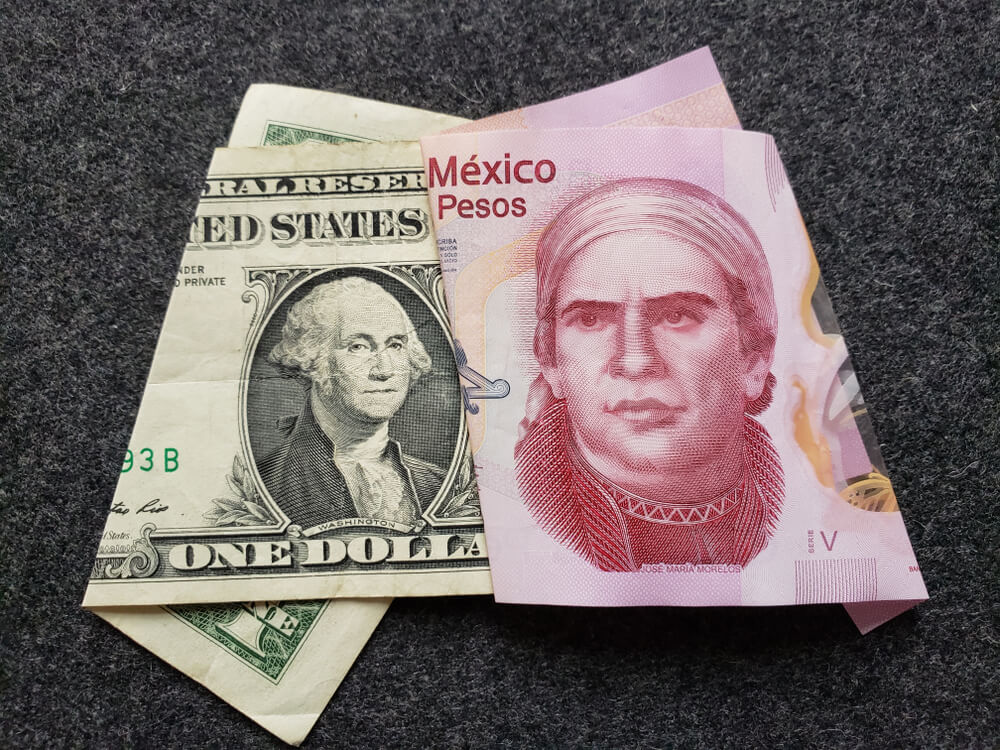

USD/MXN Hits a two-month high at 17.4256

The Mexican Peso (MXN) plunges sharply against the US Dollar (USD), accumulating losses of 2% on Thursday and 4% in the week spurred by higher US Treasury bond yields and traders beginning to unwind the carry trade. Additionally, a surprise rate cut of 50 bps by the Brazil Central Bank could be seen as setting the tone for other Latin American central banks. At the time of writing, the USD/MXN is trading at 17.3617 after hitting a daily low of 16.9800. Wall Street is trading in negative territory as investors’ mood remains depressed, courtesy in part of Fitch’s downgrade to US creditworthiness. Also, a strong US Dollar (USD) across the board underpins the USD/MXN higher, reaching a two-month-high of 17.4256 early in the North American session, as data from the United States (US) crossed the wires.